Interesting take:

How Reagan's Tax Cuts Saved Clinton and Gore

August 2001 -- US Presidents are commonly thought to influence the economy only during, or shortly after, their actual terms in office. Not true. Entitlement programs instituted by FDR and LBJ still profoundly affect our economy today. And Ronald Reagan's historic tax cuts of 1981 are still largely in effect and are still pumping huge amounts of additional money into the economy. However, Bill Clinton and Al Gore got most of the credit during their administration for the continuing economic boom unleashed by the Reagan tax cuts. That undeserved credit may have gotten Clinton re-elected and saved him from being removed from office. It almost got Gore elected too.

When Reagan took office in 1981, the US economy was in shambles. We have difficulty remembering how bad the economy was under Carter, but it was described in terms of the "misery index," and the word "stagflation" was coined to refer to the double-whammy of economic stagnation combined with runaway inflation. The automotive industry was on the verge of collapse under the pressure from Japanese competition and an oil crisis. The American way of life itself seemed to be in serious jeapordy. It wasn't the Great Depression, but it was as close as we've come to it since.

The top tax rate was 70% when Reagan took office. He got it cut in half to 35%. At the same time, he eliminated many tax shelters that the rich routinely relied on to avoid paying taxes altogether, forcing them to invest in the free market and actually pay taxes. Shortly after the tax cuts were enacted, the economy took off for an unprecedented period of peacetime growth. The misery index plummeted as unemployment fell, inflation slowed, and interest rates dropped, leading to a seven-year boom that the liberal media cynically dubbed "the decade of greed."

Eight years later George Bush swept into office on Reagan's coattails and a pledge of "no new taxes." Although he tried to keep his pledge, Bush ultimately succumbed to unrelenting pressure by the Democratically controlled Congress to increase taxes. Not surprisingly, the economy went into a mild recession, though nothing like the recession of a decade earlier. Unemployment was well below what it had been under Carter, and inflation was completely under control. Nevertheless, the liberal media shamelessly dubbed it the "worst economic period of the last fifty years."

The media hype succeeded at getting their man, Bill Clinton, elected. Although barely reported, the Bush recession had actually ended before Clinton even took office, with a vibrant 3.9% annual growth rate in the last quarter of Bush's administration. In other words, the second phase of the great Reagan economic boom had already begun before Clinton even moved to Washington. But of course that didn't stop the liberal media from giving Clinton credit for it and dubbing it the "decade of prosperity."

How can we be sure the economic boom presided over by Clinton was actually due to Reagan? It's simple. Even though Clinton increased tax rates, the top rate after his tax hikes was still less than 40%, down a full 30% from the 70% rate before Reagan's tax cuts. In terms of the money left after taxes, that's a huge jump from (100-70=) 30% to (100-40=) 60% -- a doubling of the amount of money that continues, year after year, to go into the private economy rather than the federal budget. It hardly takes an economist to understand the huge effect on economic growth of doubling after-tax income.

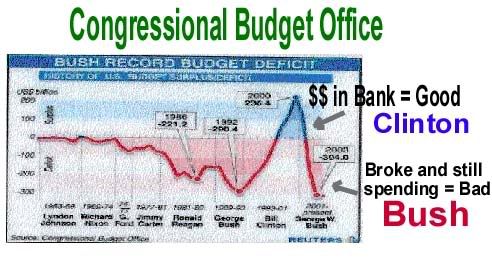

Clinton also got credit for eliminating the federal deficit, of course. It is no coincidence, however, that the deficit didn't start coming down until the Republicans took control of Congress in 1994. As for the touted "Reagan deficits," the indisputable fact is that revenues grew tremendously during Reagan's two terms -- but spending by the Democratically controlled Congress grew even faster, at an astronomical rate. And contrary to the liberal media spin, the lion's share of the growth of the federal budget under Reagan was not on defense, but rather on social entitlement programs such as social security and Medicare.

Contrary to Democratic demogoguery about "tax cuts for the rich," incidentally, the rich actually paid higher taxes after Reagan's tax cuts. How could that be? Simple. Along with cutting tax rates, Reagan also eliminated many tax shelters and loopholes. Before Reagan, the rich avoided paying taxes by investing in windmills and other boondoggles blessed by the federal government (the "targeted" tax cuts that Al Gore wanted to reinstate). After Reagan, the rich shifted their investments to the free market, greatly stimulating the private economy and causing the information technology boom.

There's more to the story, of course, but everything else is really secondary. In fairness, Clinton actually did a few things himself to help the economy, such as opening up free trade and keeping the Federal Reserve Board under competent leadership. On the other hand, if Clinton had not been restrained by the Republicans, who took control of Congress in the middle of his first term, he would have raised taxes even more than he did, and his wife would have nationalized the health care industry.

When Clinton was impeached, his party argued that he should be given a pass because he was doing a good job managing the economy. Without the huge economic boost from Reagan's tax cuts, Clinton might well have been removed from office, or might have failed to win re-election. Gore would have suffered a humiliating defeat in the election to succeed him, or might have failed to even win the nomination. But don't hold your breath waiting for the liberal media to start reporting the truth. If America wants the Reagan economic boom to continue, they need to figure out for themselves what caused it in the first place.

http://russp.org/taxcuts.html