Lets recap our money is created by banks when someone borrows it.

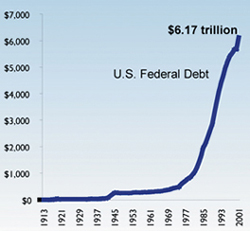

The Federal government borrows enormous sums to fund its wasteful activities it then pays back these enormous sums with interest to the people who typed it into existence.

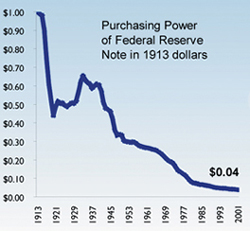

Every day the banks become steadily richer, the value of the dollar steadily declines and our buying power is reduced and our debt increased.

People are content to complain about prices when actually the real cause is monetary inflation reducing the value of our dollar. When the real reason is pointed out and who the people are that are the real beneficiaries of this system i.e. the banks and politicians. No one cares or desires to discuss it.

Its like complaining about your fever and runny nose and being told it is caused by the AIDS virus you have and you saying 'I don't want to talk about or learn about AIDS, and by the way did I mention my vomiting and diarrhea'.

The Federal government borrows enormous sums to fund its wasteful activities it then pays back these enormous sums with interest to the people who typed it into existence.

Every day the banks become steadily richer, the value of the dollar steadily declines and our buying power is reduced and our debt increased.

People are content to complain about prices when actually the real cause is monetary inflation reducing the value of our dollar. When the real reason is pointed out and who the people are that are the real beneficiaries of this system i.e. the banks and politicians. No one cares or desires to discuss it.

Its like complaining about your fever and runny nose and being told it is caused by the AIDS virus you have and you saying 'I don't want to talk about or learn about AIDS, and by the way did I mention my vomiting and diarrhea'.