Boring economics talk:

The Chinese are preparing to exit to US dollar. They currently have around $1.3 trillion in US reserves and they know full well the US government has no way to pay those debts and will default when interest rates rise; either by not paying or printing the dollar into oblivion.

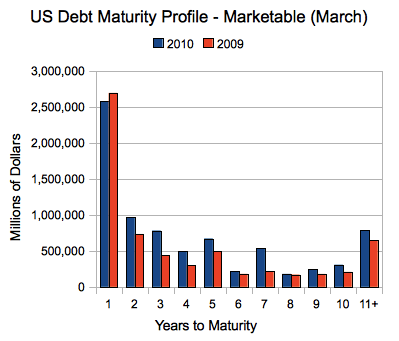

They have been rolling over all their long-term bonds into short term T-bills for many years now. Right now if they wanted to exit they would take a massive loss on their long term bonds as they sell them on the secondary market. By going into short term bonds they lose interest yield, but gain the ability to demand payment in full every 6 months to 2 years when they reach maturity.

Old pic I know, but the trend has continued.

Clinton basically put the government on an adjustable rate mortgage back in the 90's. While this made borrowing cheaper, like we saw with home mortgages, if interest rates shoot up it's "GAME OVER". The ugly truth is that in the future, when interest rates rise, every major bank that was bailed out will go bankrupt again when rates hit 2-4%. At 10% the US government will soon be in default as short term bonds mature and have to be rolled over. The Federal Reserve can currently get away with it's 0% interest rate policy without too much trouble, but that will not last forever. Right now the problems in Europe are buying the US time.

China has been buying gold as fast as they can without making the price skyrocket, but they can only divest a small amount of their reserves into that area, so they put it elsewhere, buying up lead, copper and other materials.

They are creating asset bubbles in their country by debasing their own currency to maintain the currency peg just like how the US federal reserve created the stock market and housing bubbles. While the US exports its inflation around the world so US citizens don't see it, the Chinese feel it right away and this is starting to cause grumblings in the civilian population. The Chinese government will not go down to continue subsidizing the US consumer. The Chinese Yuan will eventually float freely against the dollar.

The Chinese are simply getting ready to decouple from the US and retool for domestic consumption. When that happens and the US dollar is not longer the reserve currency, get ready for decades of inflation to come flooding back to the US as foreigners get rid of their foreign reserves.

Decoupling from the US will be expensive, however it is cheaper than continuing to prop it up. When that will happen, nobody knows. Like a game of Russian Roulette, you're eventually gonna hit the loaded chamber and the US government seems determined to continue pulling the trigger. Much like Greece, things will be fine until the moment they aren't.

We'll be learning Chinese...

Honestly what is holding China back the most is their obsolete pictograph writing system. The vast majority of the population is functionally illiterate in their own language because of this, despite the government claims. If anything they will be learning Korean, English, or something else with an alphabet to simply get away from the dead weight of their writing system.

/end boring stuff,.